The internet is borderless and ever-expanding, so when shopping online, your customers don’t expect to be restricted to paying with their credit card or other non-local options. That’s where Alternative Payment Methods – commonly referred to as APMs – come into play.

Probably you’re already familiar with the biggest digital wallets, like Apple Pay, PayPal, and Google Pay. While these global APMs are great, they constitute just a fraction of what is offered locally. Of course, cross-border commerce is not a new phenomenon, but the speed that products cross borders is increasing fast. Setting up an eCommerce web shop is an easy way for merchants to open up to new markets and immediately boost sales.

Today, geographical boundaries are less important to consumers. Cross-border sales set new records in 2020 and are projected to reach $4,820 Billion by 2026. Right now, the average of online EU16 sales sits at about 25%. However, if you focus on individual countries, that total can skyrocket. For example, Austrian shoppers make 81% of eCommerce purchases in other countries. And this exponential growth in cross-eCommerce is not limited to merchants and consumers (B2C); it is also rapidly growing between businesses, brands, and wholesalers (B2B) or between individual consumers (C2C). In an era where consumer choice reigns supreme, and cross-border eCommerce is booming at an unprecedented level, merchants who do not offer APMs are frankly missing out.

Global eCommerce

As eCommerce goes global, the need for localized payment solutions grows. While the United States represents one large market, when it comes to the EU (and you include the UK), you are looking at 51 countries, all with their own preferred local payment options. One glance at the European ecosystem makes this apparent. In the Netherlands, consumers often opt for iDEAL; in Sweden, there’s Swish; and in Germany, Giropay. That means someone in Sweden buying products in Denmark still wants to be able to pay with Swish, or a Dutch person buying from Portugal still wants to pay with iDEAL. Rather than risk an abandoned cart at checkout, merchants and other retailers need to offer these localized payment options or lose out to their competitors.

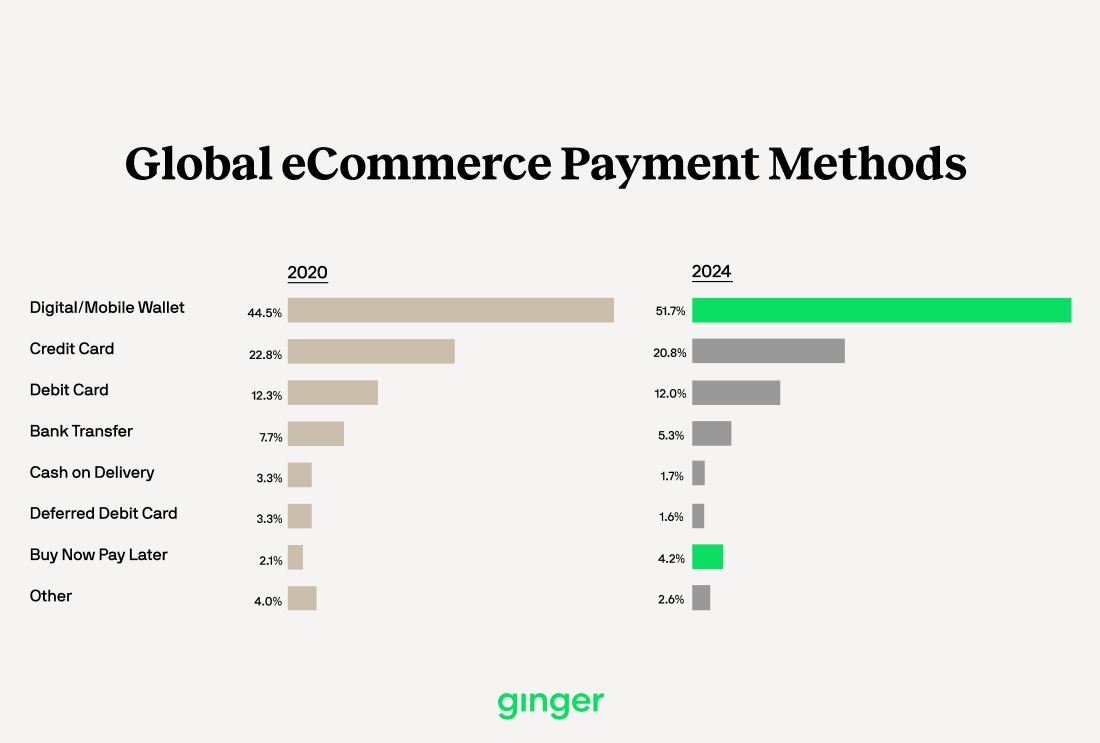

Global eCommerce Payment Methods 2020 vs 2024

Local payment methods are an essential part of a wider localization strategy that, thanks to the COVID-19 pandemic and trends with younger consumers, are more crucial now than ever. When you understand that younger generations increasingly shun both cash and credit cards, the future of APMs seems certain. For young people, there is nothing ‘alternative’ about APMs. And thanks to the pandemic, with many brick-and-mortar stores closed, APMs are on the rise with many customers opting for Buy Now Pay Later products like Klarna Pay Later, Afterpay, and Oney. These services allow shoppers to pay for expensive products in installments or only pay for the goods they opt to keep (e.g., you buy an expensive new tv online but spread out the payment over four months).

New APMs

Without these kinds of options, carts will be abandoned, conversion rates will remain low, and shoppers will migrate elsewhere for their eCommerce needs. With new APMs entering the market on what feels like a daily basis, we know it’s difficult to navigate this ever-changing landscape of localized payment options. We use our expertise in knowing what methods are needed for each market to alleviate the headache of constant research and subsequent integration.

We do the heavy lifting so you can sit back and watch your merchants’ revenue grow, attracting and retaining shoppers all over the world. Ginger is your trusted partner to build the integrations and future-proof your systems for seamless adaptability.